Equity to Offset Home Purchase Transaction Costs

import datetime as dt

import pandas as pd

import matplotlib.pyplot as plt

Create Data

def loan(date, balance, rate, payment, payment_day):

day_list = [(date, balance, 0, 0, 0, 0)]

while day_list[-1][1] > 0:

date = day_list[-1][0]

principal = day_list[-1][1]

interest = day_list[-1][2]

cum_paid_interest = day_list[-1][4]

cum_paid_principal = day_list[-1][5]

new_principal = principal

new_interest = interest + principal * rate / 365

new_date = date + dt.timedelta(1)

if new_date.day == payment_day:

if new_principal - (payment - new_interest) > 0:

paid_principal = payment - new_interest

else:

paid_principal = new_principal

new_principal -= paid_principal

cum_paid_interest += new_interest

cum_paid_principal += paid_principal

if payment > new_interest:

new_interest = 0

else:

new_interest -= payment

else:

paid_principal = 0

day_list.append((new_date, new_principal,

new_interest, paid_principal,

cum_paid_interest, cum_paid_principal))

d = pd.DataFrame(day_list,

columns=['date', 'principal', 'interest',

'paid_principal', 'cum_paid_interest',

'cum_paid_principal'])

d['date'] = pd.to_datetime(d['date'])

return d

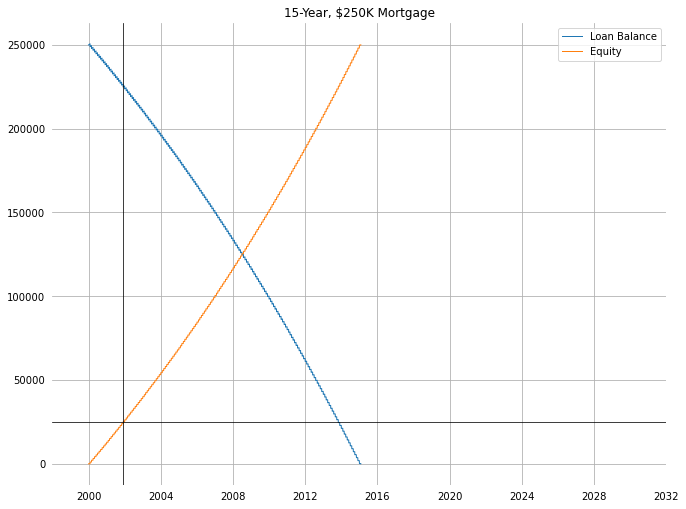

15-Year, $250K Mortgage

start_date = dt.date(2000,1,1)

balance = 250000

annual_rate = 0.035

payment = 1787

payment_day = 1

daily_15_year = loan(start_date, balance, annual_rate, payment, payment_day)

payment_day_15_year = (daily_15_year[(daily_15_year['paid_principal']!=0)|

(daily_15_year.index==0)]

.reset_index(drop=True))

payment_day_15_year.head()

| date | principal | interest | paid_principal | cum_paid_interest | cum_paid_principal | |

|---|---|---|---|---|---|---|

| 0 | 2000-01-01 | 250000.000000 | 0.0 | 0.000000 | 0.000000 | 0.000000 |

| 1 | 2000-02-01 | 248956.150685 | 0.0 | 1043.849315 | 743.150685 | 1043.849315 |

| 2 | 2000-03-01 | 247861.453405 | 0.0 | 1094.697280 | 1435.453405 | 2138.546595 |

| 3 | 2000-04-01 | 246811.247041 | 0.0 | 1050.206365 | 2172.247041 | 3188.752959 |

| 4 | 2000-05-01 | 245734.251998 | 0.0 | 1076.995043 | 2882.251998 | 4265.748002 |

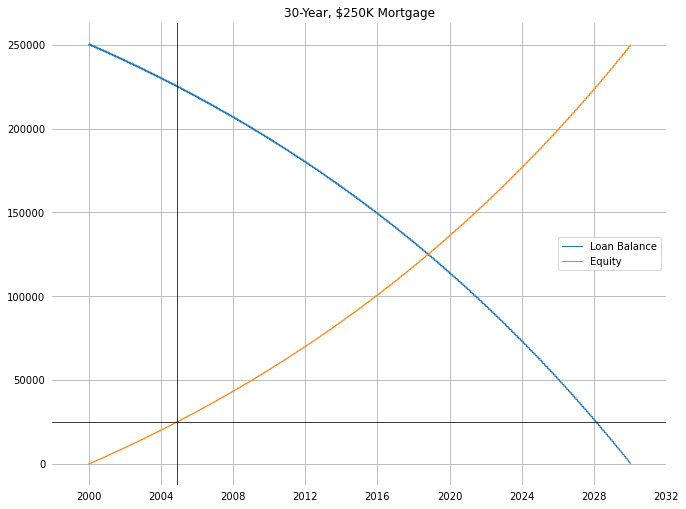

30-Year, $250K Mortgage

start_date = dt.date(2000,1,1)

balance = 250000

annual_rate = 0.035

payment = 1123

payment_day = 1

daily_30_year = loan(start_date, balance, annual_rate, payment, payment_day)

payment_day_30_year = (daily_30_year[(daily_30_year['paid_principal']!=0)|

(daily_30_year.index==0)]

.reset_index(drop=True))

payment_day_30_year.head()

| date | principal | interest | paid_principal | cum_paid_interest | cum_paid_principal | |

|---|---|---|---|---|---|---|

| 0 | 2000-01-01 | 250000.000000 | 0.0 | 0.000000 | 0.000000 | 0.000000 |

| 1 | 2000-02-01 | 249620.150685 | 0.0 | 379.849315 | 743.150685 | 379.849315 |

| 2 | 2000-03-01 | 249191.299871 | 0.0 | 428.850814 | 1437.299871 | 808.700129 |

| 3 | 2000-04-01 | 248809.046612 | 0.0 | 382.253259 | 2178.046612 | 1190.953388 |

| 4 | 2000-05-01 | 248401.798664 | 0.0 | 407.247948 | 2893.798664 | 1598.201336 |

Calculate

Assume that the total transaction costs associated with both transactions required to obtain and then sell a home (both the purchase and the subsequent sale) together amount to ~10% of the total value of the home.

How long would it take to accrue 10% equity (and therefore be “in the money”) for a 15-year mortgage? A 30-year mortgage?

- 15-Year: 23 months

- 30-Year: 59 months

percent_to_break_even = 0.10

mort_15_breakeven_date = (

payment_day_15_year[payment_day_15_year['cum_paid_principal'] > percent_to_break_even * 250000]

.head(1)

['date']

.values[0]

.astype(str)[:10])

print(mort_15_breakeven_date)

index = payment_day_15_year[payment_day_15_year['date']==mort_15_breakeven_date].index

payment_day_15_year[index.values[0]-2:index.values[0]+3]

2001-12-01

| date | principal | interest | paid_principal | cum_paid_interest | cum_paid_principal | |

|---|---|---|---|---|---|---|

| 21 | 2001-10-01 | 227131.166559 | 0.0 | 1130.357260 | 14658.166559 | 22868.833441 |

| 22 | 2001-11-01 | 226019.337287 | 0.0 | 1111.829272 | 15333.337287 | 23980.662713 |

| 23 | 2001-12-01 | 224882.529901 | 0.0 | 1136.807386 | 15983.529901 | 25117.470099 |

| 24 | 2002-01-01 | 223764.016326 | 0.0 | 1118.513575 | 16652.016326 | 26235.983674 |

| 25 | 2002-02-01 | 222642.177854 | 0.0 | 1121.838472 | 17317.177854 | 27357.822146 |

mort_30_breakeven_date = (

payment_day_30_year[payment_day_30_year['cum_paid_principal'] > percent_to_break_even * 250000]

.head(1)

['date']

.values[0]

.astype(str)[:10])

print(mort_30_breakeven_date)

index = payment_day_30_year[payment_day_30_year['date']==mort_30_breakeven_date].index

payment_day_30_year[index.values[0]-2:index.values[0]+3]

2004-12-01

| date | principal | interest | paid_principal | cum_paid_interest | cum_paid_principal | |

|---|---|---|---|---|---|---|

| 57 | 2004-10-01 | 225645.052294 | 0.0 | 472.524778 | 39656.052294 | 24354.947706 |

| 58 | 2004-11-01 | 225192.805395 | 0.0 | 452.246899 | 40326.805395 | 24807.194605 |

| 59 | 2004-12-01 | 224717.620314 | 0.0 | 475.185080 | 40974.620314 | 25282.379686 |

| 60 | 2005-01-01 | 224262.616528 | 0.0 | 455.003786 | 41642.616528 | 25737.383472 |

| 61 | 2005-02-01 | 223806.260197 | 0.0 | 456.356332 | 42309.260197 | 26193.739803 |

Visualize

def create_loan_payoff_plot(d, title, breakeven_date):

fig = plt.figure(figsize=[11,8.5])

ax = fig.gca()

ax.grid(True)

ax.spines['left'].set_visible(False)

ax.spines['top'].set_visible(False)

ax.spines['right'].set_visible(False)

ax.spines['bottom'].set_visible(False)

plt.tick_params(

axis='y',

left=False)

plt.tick_params(

axis='x',

bottom=False)

ax.set_xlim([dt.date(1998,1,1),dt.date(2032,1,1)])

plt.title(title)

ax.plot(d['date'],

d['principal'] + d['interest'],

linewidth=1,

label='Loan Balance')

ax.plot(d['date'],

d['cum_paid_principal'],

linewidth=1,

label='Equity')

ax.axvline(breakeven_date,

color='k',

linewidth=0.75)

ax.axhline(25000,

color='k',

linewidth=0.75)

ax.legend()

15-Year, $250K Mortgage

create_loan_payoff_plot(daily_15_year,

'15-Year, $250K Mortgage',

pd.to_datetime(mort_15_breakeven_date))

30-Year, $250K Mortgage

create_loan_payoff_plot(daily_30_year,

'30-Year, $250K Mortgage',

pd.to_datetime(mort_30_breakeven_date))