Disclaimer: Any information found on this page is not to be considered as

financial advice. You should do your own research before making any decisions.

financial advice. You should do your own research before making any decisions.

Historical Bitcoin Returns Analysis

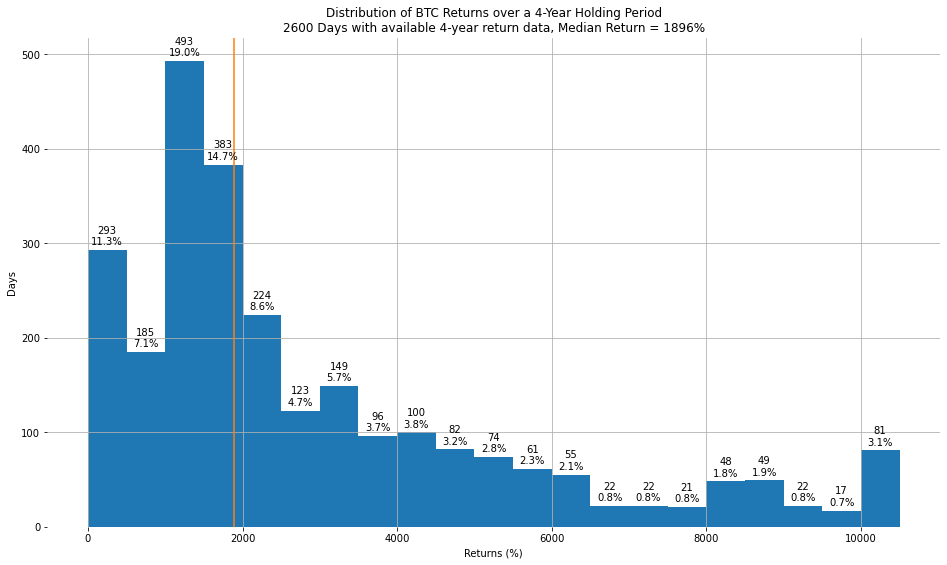

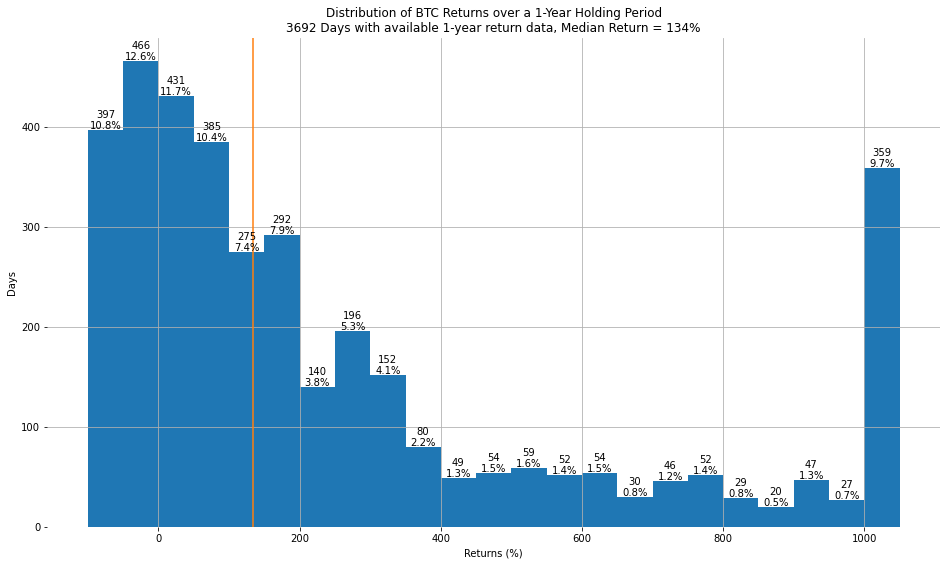

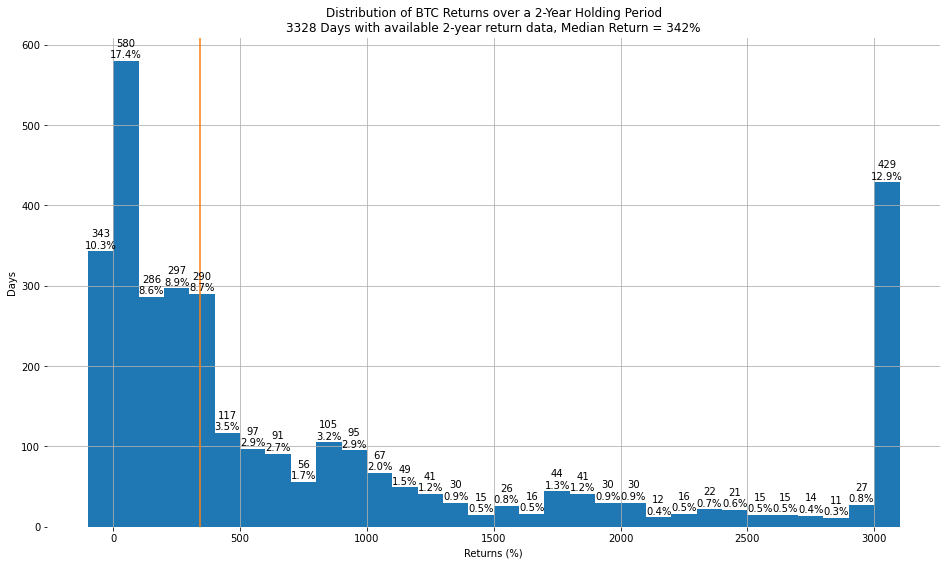

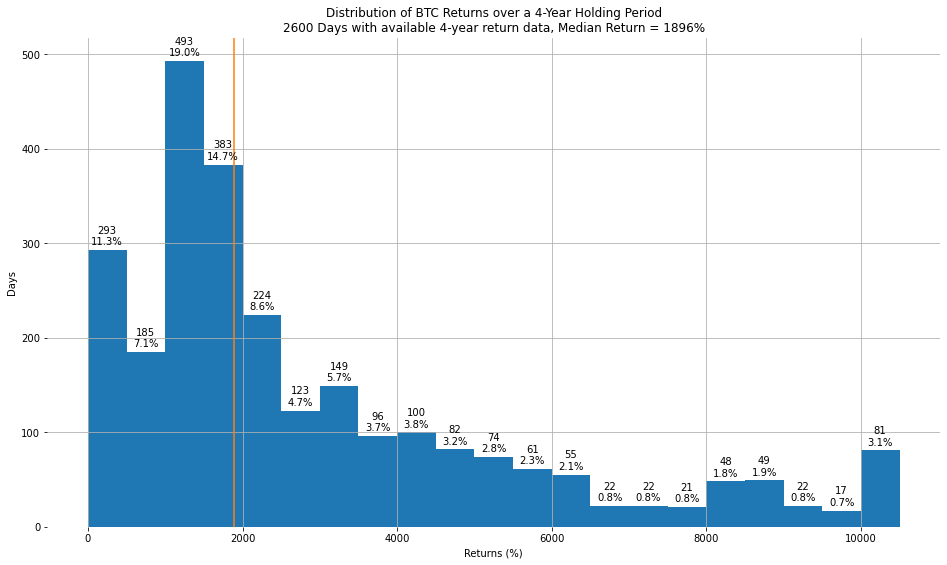

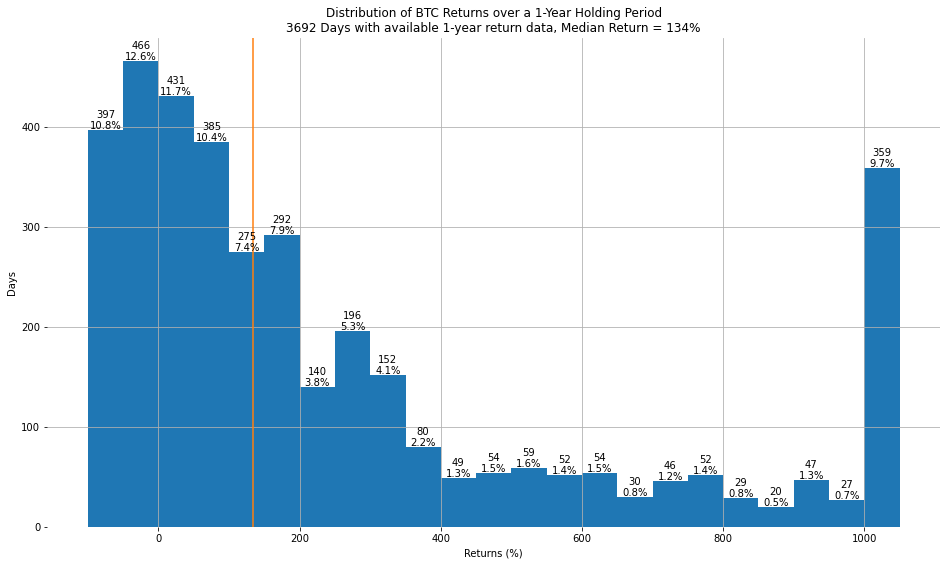

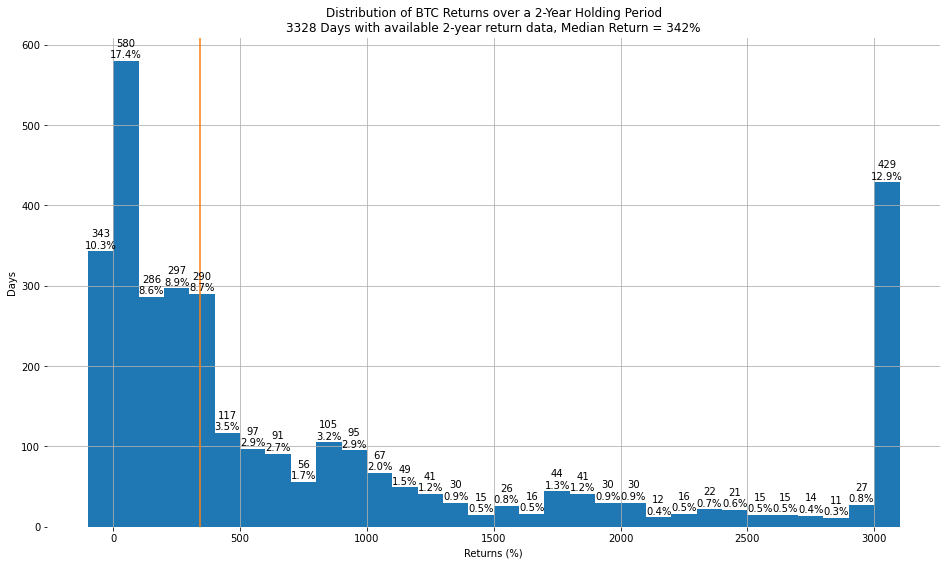

Objective of this analysis is to determine the distribution of Bitcoin returns over 1, 2, and 4 year holding intervals.

The outcome of the analysis is the set of three visuals, shown below.

Open Raw Data

Data from August 18, 2011 until August 2, 2021 was taken from a tradingview.com export of Bitcoin pricing from the Bitstamp exchange. Data after August 2, 2021 was taken from an API pull of pricing data from CoinAPI.

import datetime as dt

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import matplotlib as mpl

d = pd.read_csv('historical-bitcoin-returns-analysis/btc_daily_closing_price.csv')

print('Earliest date: {}\nLatest date: {}\n'.format(d['time'].min(),d['time'].max()))

d.info()

d.head()

Earliest date: 2011-08-18T00:00:00Z

Latest date: 2022-09-24T00:00:00.0000000Z

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 4023 entries, 0 to 4022

Data columns (total 2 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 time 4023 non-null object

1 close 4023 non-null float64

dtypes: float64(1), object(1)

memory usage: 63.0+ KB

| time | close | |

|---|---|---|

| 0 | 2011-08-18T00:00:00Z | 10.90 |

| 1 | 2011-08-19T00:00:00Z | 11.69 |

| 2 | 2011-08-20T00:00:00Z | 11.70 |

| 3 | 2011-08-21T00:00:00Z | 11.70 |

| 4 | 2011-08-22T00:00:00Z | 11.70 |

Basic Cleansing

- Convert “time” to “date”

- Identify any missing days by merging into a complete list of dates from the start to end date

- Subset to just the minimally necessary columns

d['date'] = pd.to_datetime(d['time'])

complete_date_list = pd.DataFrame(

pd.date_range(d['date'].min(),

d['date'].max()),

columns=['date'])

print(d.shape)

d = (pd.merge(complete_date_list, d,

on=['date'],

how='left')

.reset_index(drop=True))

print(d.shape)

(4023, 3)

(4056, 3)

d = d.drop(columns=['time'])

Exploration

- A total of 33 days are missing pricing information. This is less than 1% of the total values in the dataset, and 30/33 were in 2011. Clean by filling the values forward.

d[d['close'].isna()]['date'].dt.year.value_counts()

2011 30

2015 3

Name: date, dtype: int64

d['close'] = d['close'].fillna(method='ffill')

d.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 4056 entries, 0 to 4055

Data columns (total 2 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 4056 non-null datetime64[ns, UTC]

1 close 4056 non-null float64

dtypes: datetime64[ns, UTC](1), float64(1)

memory usage: 63.5 KB

Calculate Returns

Use a 364-day year. Subtract 1 so that a return of 0.1 means a 10% return, and a return of -0.1 means a 10% loss.

d['1-year prior close'] = d.shift(364)['close']

d['2-year prior close'] = d.shift(364 * 2)['close']

d['4-year prior close'] = d.shift(364 * 4)['close']

d['1-year return'] = (d['close']/d['1-year prior close'] - 1) * 100.

d['2-year return'] = (d['close']/d['2-year prior close'] - 1) * 100.

d['4-year return'] = (d['close']/d['4-year prior close'] - 1) * 100.

d.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 4056 entries, 0 to 4055

Data columns (total 8 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 4056 non-null datetime64[ns, UTC]

1 close 4056 non-null float64

2 1-year prior close 3692 non-null float64

3 2-year prior close 3328 non-null float64

4 4-year prior close 2600 non-null float64

5 1-year return 3692 non-null float64

6 2-year return 3328 non-null float64

7 4-year return 2600 non-null float64

dtypes: datetime64[ns, UTC](1), float64(7)

memory usage: 253.6 KB

Visualize

np.clip in the call to the histogram function, below, clips the extreme values to be in the smallest/largest bins.

d[~d['4-year prior close'].isna()].head()

| date | close | 1-year prior close | 2-year prior close | 4-year prior close | 1-year return | 2-year return | 4-year return | |

|---|---|---|---|---|---|---|---|---|

| 1456 | 2015-08-13 00:00:00+00:00 | 264.48 | 507.99 | 98.08 | 10.90 | -47.935983 | 169.657423 | 2326.422018 |

| 1457 | 2015-08-14 00:00:00+00:00 | 265.40 | 500.25 | 98.25 | 11.69 | -46.946527 | 170.127226 | 2170.316510 |

| 1458 | 2015-08-15 00:00:00+00:00 | 261.46 | 521.97 | 99.71 | 11.70 | -49.908999 | 162.220439 | 2134.700855 |

| 1459 | 2015-08-16 00:00:00+00:00 | 256.11 | 496.86 | 99.30 | 11.70 | -48.454293 | 157.915408 | 2088.974359 |

| 1460 | 2015-08-17 00:00:00+00:00 | 256.47 | 475.22 | 102.85 | 11.70 | -46.031312 | 149.363150 | 2092.051282 |

d[~d['4-year prior close'].isna()].tail()

| date | close | 1-year prior close | 2-year prior close | 4-year prior close | 1-year return | 2-year return | 4-year return | |

|---|---|---|---|---|---|---|---|---|

| 4051 | 2022-09-20 00:00:00+00:00 | 19539.040269 | 42820.865901 | 10534.31 | 6428.99 | -54.370282 | 85.480020 | 203.920838 |

| 4052 | 2022-09-21 00:00:00+00:00 | 18874.158632 | 40720.098608 | 10233.42 | 6461.51 | -53.649035 | 84.436470 | 192.101361 |

| 4053 | 2022-09-22 00:00:00+00:00 | 18500.246285 | 43568.796718 | 10744.02 | 6681.62 | -57.537854 | 72.191101 | 176.882646 |

| 4054 | 2022-09-23 00:00:00+00:00 | 19402.480290 | 44892.151371 | 10689.81 | 6610.76 | -56.779794 | 81.504445 | 193.498483 |

| 4055 | 2022-09-24 00:00:00+00:00 | 19400.584671 | 42836.736645 | 10729.09 | 6579.38 | -54.710405 | 80.822275 | 194.869496 |

which_period = '1-year return'

plt.figure(figsize=(16,9), facecolor='white')

bins=np.arange(-100,1100,50)

plt.hist(np.clip(d[which_period], bins[0], bins[-1]),

bins=bins)

plt.grid()

for spine in plt.gca().spines.values():

spine.set_visible(False)

plt.ylabel('Days')

plt.xlabel('Returns (%)')

plt.title('''Distribution of BTC Returns over a 1-Year Holding Period

{} Days with available 1-year return data, Median Return = {}%'''

.format(d[~d[which_period].isna()].shape[0],

int(round(d[which_period].median(),0))))

rects = plt.gca().patches

for n, r in enumerate(rects):

height = r.get_height()

plt.gca().text(r.get_x() + r.get_width() / 2,

height + 10,

(str(int(height)) + '\n'

+ str(((height/d[~d[which_period].isna()].shape[0])*100.)

.round(1)) + '%'),

ha='center',

va='center')

plt.axvline(d[which_period].median(),

c='C1');

which_period = '2-year return'

plt.figure(figsize=(16,9), facecolor='white')

bins=np.arange(-100,3200,100)

plt.hist(np.clip(d[which_period], bins[0], bins[-1]),

bins=bins)

plt.grid()

for spine in plt.gca().spines.values():

spine.set_visible(False)

plt.ylabel('Days')

plt.xlabel('Returns (%)')

plt.title('''Distribution of BTC Returns over a 2-Year Holding Period

{} Days with available 2-year return data, Median Return = {}%'''

.format(d[~d[which_period].isna()].shape[0],

int(round(d[which_period].median(),0))))

rects = plt.gca().patches

for n, r in enumerate(rects):

height = r.get_height()

plt.gca().text(r.get_x() + r.get_width() / 2,

height + 15,

(str(int(height)) + '\n'

+ str(((height/d[~d[which_period].isna()].shape[0])*100.)

.round(1)) + '%'),

ha='center',

va='center')

plt.axvline(d[which_period].median(),

c='C1');

which_period = '4-year return'

plt.figure(figsize=(16,9), facecolor='white')

bins=np.arange(0,11000,500)

plt.hist(np.clip(d[which_period], bins[0], bins[-1]),

bins=bins)

plt.grid()

for spine in plt.gca().spines.values():

spine.set_visible(False)

plt.ylabel('Days')

plt.xlabel('Returns (%)')

plt.title('''Distribution of BTC Returns over a 4-Year Holding Period

{} Days with available 4-year return data, Median Return = {}%'''

.format(d[~d[which_period].isna()].shape[0],

int(round(d[which_period].median(),0))))

rects = plt.gca().patches

for n, r in enumerate(rects):

height = r.get_height()

plt.gca().text(r.get_x() + r.get_width() / 2,

height + 15,

(str(int(height)) + '\n'

+ str(((height/d[~d[which_period].isna()].shape[0])*100.)

.round(1)) + '%'),

ha='center',

va='center')

plt.axvline(d[which_period].median(),

c='C1');