Exiting Altcoin Positions

Low-cap altoins tend to “moon” in some situations, reaching very high valuations all at once as the market FOMOs into the coin on the way up. Returns can easily be 5x to 10x the initial purchase amount. By setting sell orders at fixed multiples of the initial purchase price, investors can exit positions using an algorithmic approach. This approach limits emotional decision-making while prices are rapidly climbing or dropping.

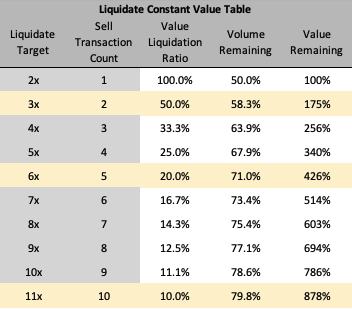

Liquidating Constant Value

Specific example:

- 100 units purchase at \$1 per unit for a total initial expense of \$100. Assume targeting an exit when the inital investment has 6x’d, so sell 20% of the initial investment value every incremental 100% return from the original purchase price.

- Sell \$20.00 (10 units) when price reaches \$2 per unit.

- Sell \$20.00 (6.67 units) when price reaches \$3 per unit.

- Sell \$20.00 (5 units) when price reaches \$4 per unit.

- Sell \$20.00 (4 units) when price reaches \$5 per unit.

- Sell \$20.00 (3.33 units) when price reaches \$6 per unit.

- At that point, the entire \$100 initial investment has been recouped.

- 71% of the initial purchase volume are still held, and at the last valuation they are worth 426% of the initial purchase value.

Liquidation Pattern

Selling the liquidation ratio percent of the initial purchase volume at each 100% return will completely liquidate the position within transaction count transactions, when the initial purchased has gone up by liquidate target percent. At that point, volume remaining percent of the initial purchase volume will be left, worth value remaining percent of the initial purchase value, assuming the price is the same as it was at the last valuation transacted.

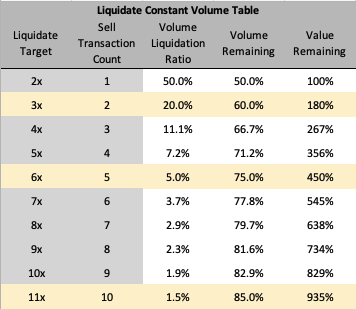

Liquidating Constant Volume

For example, selling 20% of the initial purchase by volume per 100% return on initial investment will completely liquidate the initial position when that position has 3x’d, after 2 sell transactions. After those transactions, 60% of the initial purchase volume will be left, but at that valuation it will be worth 180% of the initial purchase value.

Another specific example:

- 100 units purchase at \$1 per unit for a total initial expense of \$100. Assume targeting an exit when the inital investment has 6x’d, so sell 5.0% of the initial investment volume every 100% return.

- Sell 5 units when price reaches \$2 per unit, recouping \$10.

- Sell 5 units when price reaches \$3 per unit, recouping \$15.

- Sell 5 units when price reaches \$4 per unit, recouping \$20.

- Sell 5 units when price reaches \$5 per unit, recouping \$25.

- Sell 5 units when price reaches \$6 per unit, recouping \$30.

- At that point, the entire \$100 initial investment has been recouped.

- 75% of the initial purchase volume are still held, and at the last valuation they are worth 450% of the initial purchase value.

Liquidation Pattern