Electric Vehicle Total Cost of Ownership

Do the gas savings associated with driving an electric vehicle offset their more rapid depreciation yet? Is a Chevy Volt, Chevy Bolt, or Nissan Leaf as economical to drive as a used Toyota Corolla in 2021?

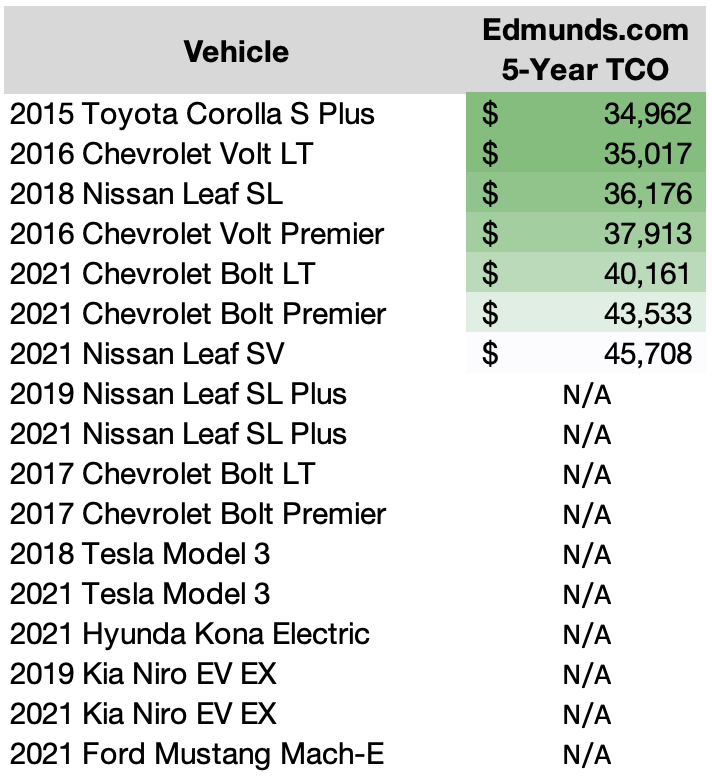

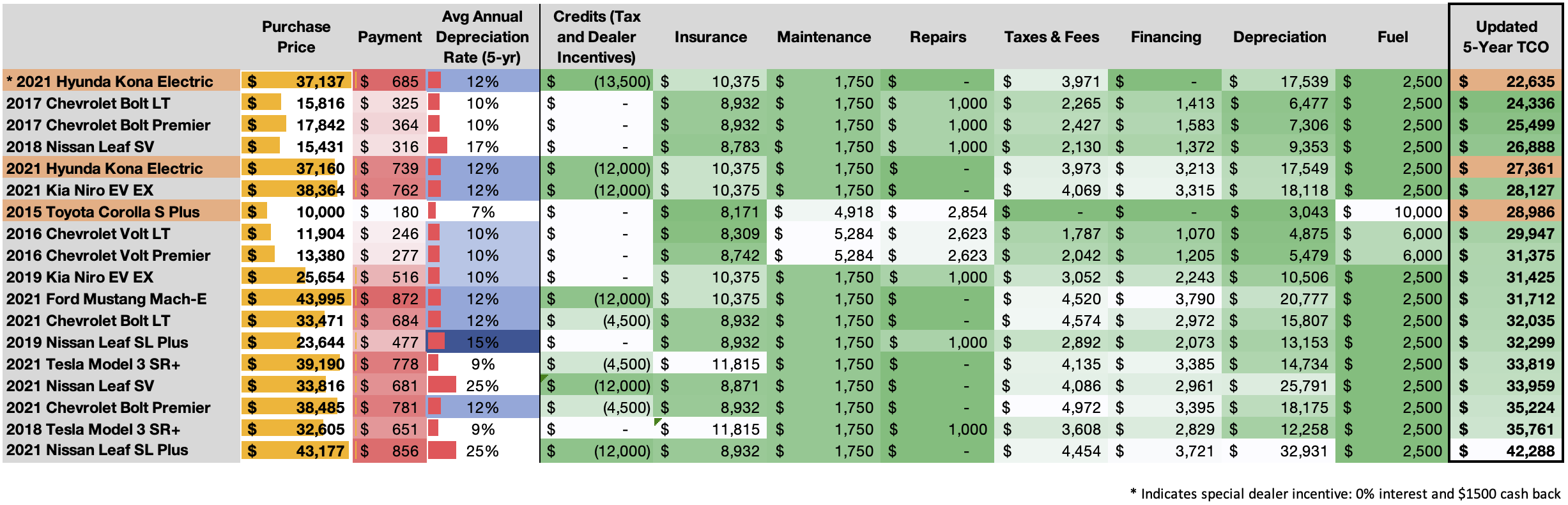

Edmunds.com’s 5-Year Total Costs of Ownership suggests that ownership costs for some of these vehicles are similar.

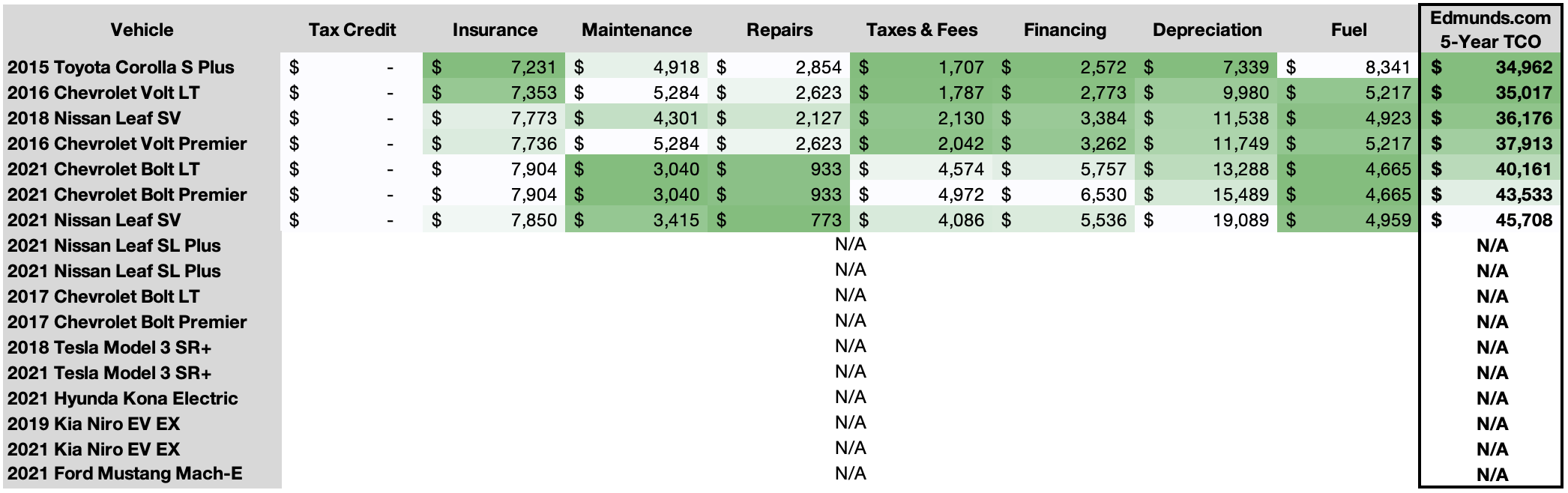

Edmunds.com’s 5-Year Ownership Costs disaggregate into 8 categories. The following values are taken directly from Edmunds.com. The rest of this page is my attempt to make these values more accurate. The result is the table in the “Final Ranking” section.

Notes:

- The Chevy Volt was redesigned in 2016.

- TCOs for used prices for Chevy Bolt (sold since 2017) were not available at time I compiled these notes.

- The Nissan Leaf was redesigned in 2018.

- Edmunds.com does not currently have TCO reported for Tesla Model 3’s, Hyundai Kona Electrics, or Ford Mustang Mach-E.

- Edmunds references: 2015 Toyota Corolla S Plus, 2016 Chevrolet Volt LT, 2016 Chevrolet Volt Premier, 2021 Chevrolet Bolt LT, 2021 Chevrolet Bolt Premier, 2018 Nissan Leaf SL

Refinements to Edmunds.com TCO Numbers

Tax Credit

- There are at least 3 tax credits and incentives currently available for new electric vehicle purchases in my area:

- \$7500 - Federal Tax Credit - No longer available for Chevrolet or Tesla.

- \$1500 - California Clean Fuel Reward - point-of-sale reward available to CA residents who purchase or lease new BEVs/PHEVs.

- https://cleanfuelreward.com - new BEV or PHEV vehicles registered in CA and purchased by CA residents

- Point-of-sale reward available at participating retailers only

- \$3000 - San Joaquin Valley AQMD Drive Clean in the San Joaquin - rebates for purchase or lease of eligible new vehicles including EVs.

- \$2000 - California Clean Vehicle Rebate Project - limited availability as of 4/23/21, not included in this analysis.

- So, the total available for most new EV purchases is \$12,000, while the total available for Tesla and Chevrolet new EVs is \$4500.

Insurance

- My current 2015 Toyota Corolla S Plus costs \$678 to ensure for 6 months. Over 5 years this is \$8136, which is 13% more than the value reported by Edmunds.com. The insurance costs reported by Edmunds for all the vehicles have been increased by that proportion.

- (reviewing later, this was wrong, s/b \$6780 over 5 years. All vehicles compared had insurance costs that were a bit inflated as a result.)

- Anecdotally, Teslas are very expensive to insure due to high repair and maintenance costs.

- NerdWallet reports the average cost of insuring a Tesla Model 3 is \$2215 per year, which is more than 50% higher than the national average cost of car insurance.

- ValuePenguin reports that Tesla’s own insurance product costs an average of \$2363 per year in California. That cost extrapolated out over 5 years has been added to the table.

- I have assumed a value in-between the Chevy Volt (\$8932) and Tesla Model 3 (\$11,815) for insurance for the Mustang and Kona (\$10,375).

Maintenance

- Maintenance costs are assumed to be \$2000 for all EVs on the list.

- Maintenance costs for other vehicles are unchanged from the values reported by Edmunds.com.

Repairs

- Repair costs for new EVs are assumed to be \$0.

- Repair costs for used EVs are assumed to be \$1000.

- Repair costs for other vehicles are unchanged from the values reported by Edmunds.com.

Taxes & Fees

- Where these fees are not available from Edmunds.com:

- Taxes are assumed to be 8% of the purchase price.

- “Other fees” are assumed to be \$500 for used values, \$1000 for new vehicles.

- As I already own the Corolla, Taxes & Fees on that vehicle are \$0.

Financing

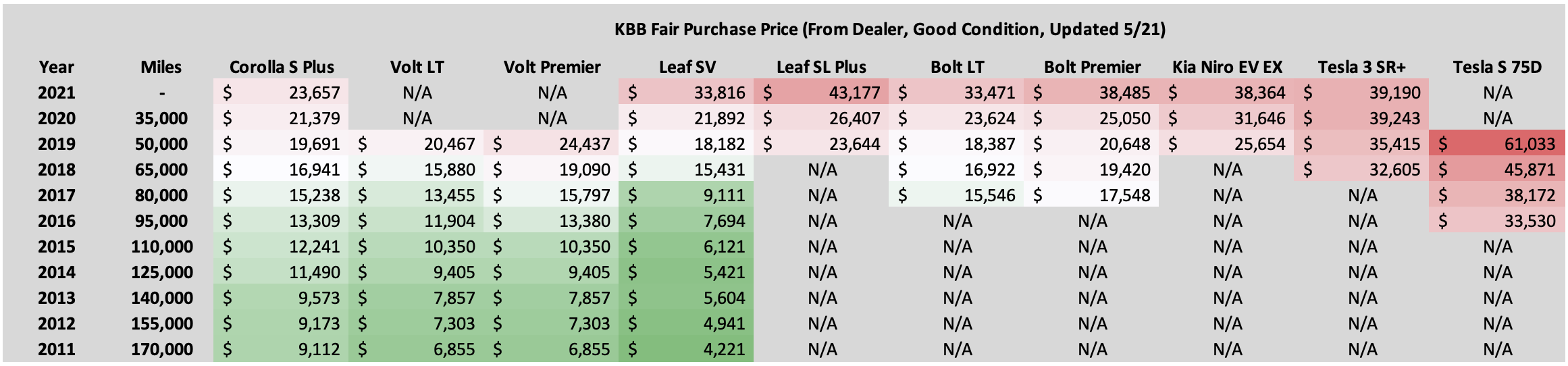

- Financing costs is calculated as the total interest paid on a loan for the KBB dealer purchase price + taxes & fees.

- The terms of the loan are assumed to be 3% annual interest on a 60-month loan.

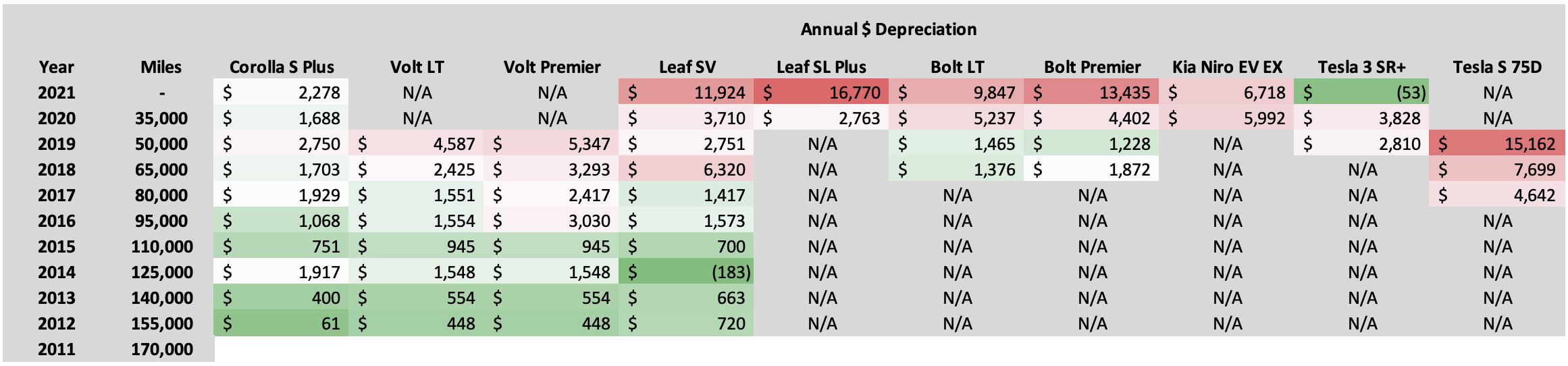

Depreciation

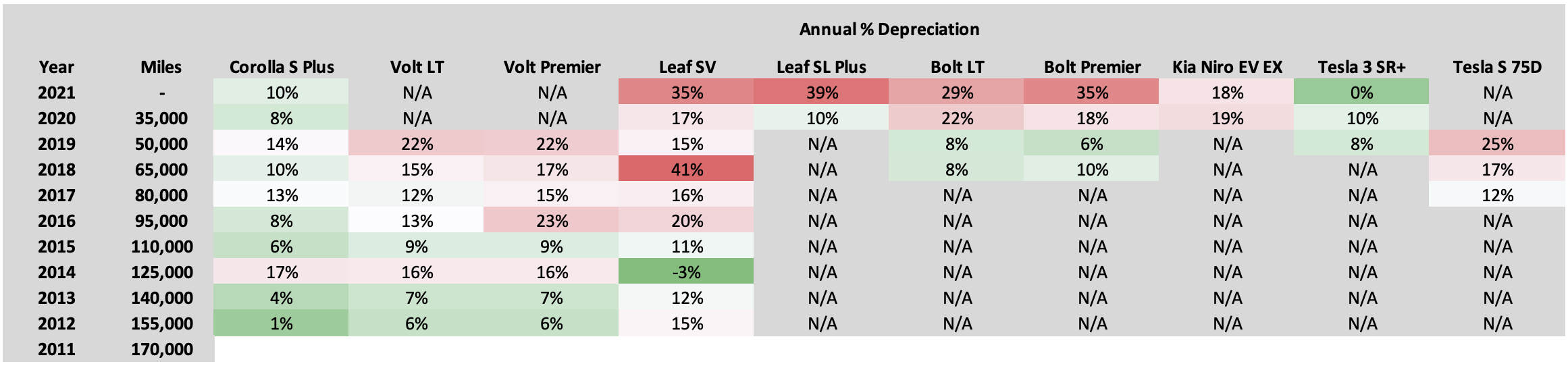

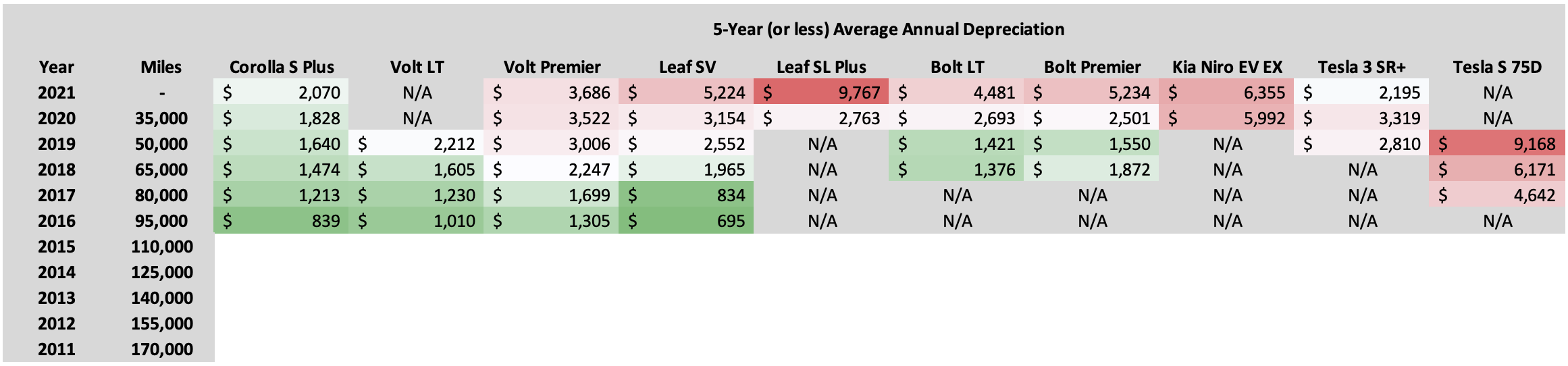

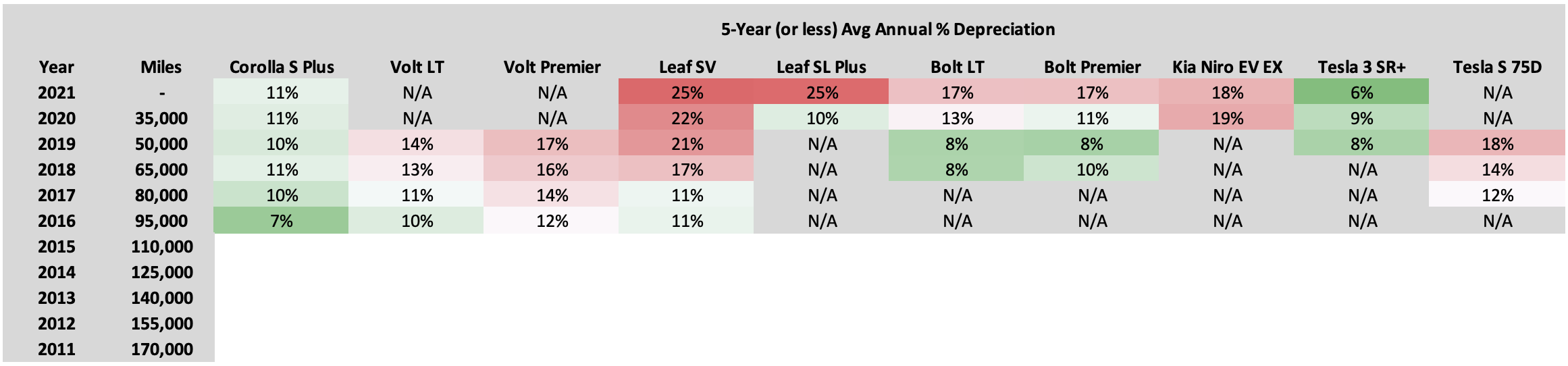

- Vehicle depreciation is the single largest contributor to total cost of ownership for most vehicles. It is also particularly difficult to estimate for EVs given their rapidly evolving and relatively unproven battery technology.

- I have estimated depreciation based on average annual reduction in the fair purchase prices of the same vehicles but 5 years older. For example, today, a 2019 Corolla might sell for \$20,726, whereas a 2014 Corolla would sell for \$13,018.

- So, on average, the Corolla would be expected to lose value at roughly \$1401 per year.

- The following are essentially “smoothed out” versions of the noisier pricing information in the tables above. While appearing to present “cleaner” trends, they are also one step further removed from reality in a sense.

- One interesting trend I noticed with Chevy Bolt depreciation is the very sharp decrease in annual depreciation once the vehicle reaches values around \$16K-\$20K. My hypothesis is that its at this price that the sort of TCO considerations I’m exploring here become really compelling. A car that requires near-zero maintenance and much less-expensive fuel (electricity, not gas) becomes compelling from an ownership cost perspective at around \$15K-\$20K.

- My hypothesis is that those TCO considerations create a relatively higher “value-floor” than you would otherwise see for gas-powered cars, for which maintenance costs become increasingly important as the vehicle ages.

- Given this observation, I’m going to make some strong assumptions about annual EV depreciation in my final analysis to reflect this apparent value floor for certain EVs with high quality (actively managed thermals) battery technology.

- Nissan Leaf uses a passively-cooled battery pack that has less longevity than liquid-cooled packs, especially in hotter climates.

- Specifically, max depreciation for:

- New EVs: 12% annually unless the vehicles are already depreciating less according to the table above, in which case that value is used. After 5 years, this is 47% depreciation. This feels like a reasonable assumption given:

- New Corollas, also known for high reliability and low TCO, depreciate much less than this at 36% over 5 years (price gap between 2017 and 2021, above), so this level of low level of depreciation is not unheard of.

- 2017 Bolts (both trims) are worth 46% of the value of 2021 Bolts, and the Bolt is generally considered to have aged poorly due to polarizing styling.

- Used EVs (2019 or older): 10% annually, again unless the vehicles are already depreciating less according to the table above. After 5 years, this is 40% depreciation.

- Ex: a \$25K purchase price vehicle would be worth \$14,700 after 5 years. This feels reasonable.

- New EVs: 12% annually unless the vehicles are already depreciating less according to the table above, in which case that value is used. After 5 years, this is 47% depreciation. This feels like a reasonable assumption given:

Fuel

- 20,000 miles driven annually

- Assumed \$2500 over five years for EV fast-charging

Corolla

$$ 5\ years \left( \frac{20,000\ miles}{1\ year} \right) \left( \frac{1}{35\ MPG} \right) \left( \frac{\$3.50}{gal} \right) = \$10K$$

Volt

- Assume 32 miles/day are offset due to charging for free at work.

$$\left(\frac{50\ work\ weeks}{year}\right) \left(\frac{5\ workdays}{work\ week}\right) \left(\frac{32\ miles}{workday}\right) \left(\frac{1}{35\ MPG}\right) \left(\frac{\$3.50}{gal}\right) = \$800$$

$$\left(\frac{$10K}{5\ years}\right) - 5\ years \left(\frac{$800}{year}\right) = \$6K$$

Final Ranking

- Blue “Avg Annual Depreciation Rate (5-yr)” figures in the table below indicate a strong assumption about how quickly the corresponding EV will lose value over time.

Other Considerations

Liquid- versus Air-Cooled Batteries

- “If you live in a hot climate where the Summer temperatures regularly hit triple digits Fahrenheit… buying an electric car with a passively-cooled battery pack like the Nissan Leaf or Volkswagen e-Golf isn’t a smart move unless you know for sure you’ve got somewhere cool to park and charge it. Even then, you’re better off guy a car with liquid cooling.” - YouTube video

- The Nissan Leaf and Hyundai Ioniq use a passively-cooled battery

Cashflow Comparison

- Cashflows would include any “real,” ongoing monthly expenses associated with keeping the current vehicle or buying a new one:

- Included: Car Payment, Insurance, Maintenance, Repairs, Financing, Fuel

- Excluded: Depreciation, Tax Credit (1st year only), Taxes & Fees (1st year only)

Keep current Toyota Corolla

- Monthly Car Payment: $\$0$

- Monthly Ongoing Expenses: $\frac{28,986 - 3,043}{60\ months} = -\$432$

- Annually: $-\$5184$

- One-Time Tax Credits: $\$0$

- One-Time Lump sum payment from sale of vehicle: $\$0$

| Current Vehicle | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Annual Cash Cashflow | - \$5,184 | - \$5,184 | - \$5,184 | - \$5,184 | - \$5,184 | - \$5,184 | - \$5,184 |

| Cumulative Cash Cashflow | - \$5,184 | - \$10,368 | - \$15,552 | - \$20,736 | - \$25,920 | - \$31,104 | - \$36,288 |

Purchase New EV (Hyundai Kona)

- Note: uses special incentives cost structure in Final Rankings table, above.

- Monthly Car Payment (5 years): $-\$685$

- Annually: $-\$8220$

- Monthly Ongoing Expenses: $\frac{22,635-17,539-(-13,500)-3,971}{60\ months} = -\$244$

- Annually: $-\$2928$

- One-Time Tax Credits: $+\$12,000$

- One-Time Lump sum payment from sale of vehicle: $+\$9,000$

| New Electric Vehicle | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Annual Cash Cashflow | + \$9,852 | - \$11,148 | - \$11,148 | - \$11,148 | - \$11,148 | - \$2,928 | - \$2,928 |

| Cumulative Cash Cashflow | + \$9,852 | - \$1,296 | - \$12,444 | - \$23,592 | - \$34,740 | - \$37,668 | - \$40,596 |

Delta

- The cashflow delta between purchasing a new EV relative to retaining my current one is shown below. In the short term, I would be money ahead, and moving in the direction of breaking even once the new EV is paid for after 60 months.

| Cash Flow Delta | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| New EV Cumulative Cashflow | + \$9,852 | - \$1,296 | - \$12,444 | - \$23,592 | - \$34,740 | - \$37,668 | - \$40,596 |

| Current Vehicle Cumulative Cashflow | - \$5,184 | - \$10,368 | - \$15,552 | - \$20,736 | - \$25,920 | - \$31,104 | - \$36,288 |

| Cumulative Cashflow Delta | + \$15,036 | + \$9,072 | + \$3,108 | - \$2,856 | - \$8,820 | - \$6,564 | - \$4,308 |

Cost Analysis from Actual Purchase

- Total cash price of purchase of 2021 Hyundai Kona Ultimate, associated plans, fees, etc purchased 5/18/21: \$49,480

- Sale Price of 2021 Hyundai Kona Ultimate: \$43,800

- KBB Fair Purchase Price \$45,182

- KBB Fair Market Range \$43,709 - \$46,654

- Purchased 60 month “Platinum Vehicle Protection”: \$305

- Purchased 120 month, 120K mile “Hyundai Protection Plan”: \$1,640

- Sales tax \$3,620

- Various Fees \$115

- Sale Price of 2021 Hyundai Kona Ultimate: \$43,800

- Other license fees, registration fees, etc: \$620

- Down Payment \$13,000

- Traded in 2015 Toyota Corolla S Plus for \$10,000

- KBB Fair Purchase Price “Good” condition \$8905

- KBB Fair Market Range “Good” condition \$8,031 - \$9,778

- (Itself purchased 11/11/14 for \$18,791.60. So, actual average annual actual depreciation ~9.3%)

- Manufacturer incentive \$1,500

- California Clean Fuel Reward \$1,500

- Traded in 2015 Toyota Corolla S Plus for \$10,000

- Financed sum of line items above, \$37,100, for 0% over 60 months with payment \$618

- Annual running costs: \$2268

- 6 Month Insurance Premium \$759 (increased from \$678)

- Insurance per year: \$1518

- Fuel per year: \$500 (assumed - may be high)

- Maintenance per year: \$250 (assumed)

- Total annual cost for first five years: \$9684, thereafter: \$2268

- Total annual cost for Corolla (corrected insurance): \$4913

Value Comparisons with Actuals

| Actual New EV Purchase | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Vehicle Value | + \$31,800 | + \$27,984 | + \$24,625 | + \$21,670 | + \$19,070 | + \$16,781 | + \$14,768 |

| Vehicle Equity | + \$13,000 | + \$20,416 | + \$27,832 | + \$35,248 | + \$42,664 | N/A | N/A |

| Vehicle Value or Equity | + \$13,000 | + \$20,416 | + \$24,625 | + \$21,670 | + \$19,070 | + \$16,781 | + \$14,768 |

| Cumulative Cashflow | + \$816 | - \$8,868 | - \$18,552 | - \$28,236 | - \$37,920 | - \$40,188 | - \$42,456 |

| Total Value | + \$13,816 | + \$11,548 | + \$9,280 | - \$6,566 | - \$18,850 | - \$23,407 | - \$27,688 |

- The following table uses corrected Corolla insurance values for that vehicle’s cashflow.

| Corolla (updated insurance) | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Vehicle Value | + \$9,648 | + \$8,973 | + \$8,345 | + \$7,761 | + \$7,218 | + \$6,713 | + \$6,243 |

| Cumulative Cashflow | - \$4,913 | - \$9,826 | - \$14,739 | - \$19,652 | - \$24,565 | - \$29,478 | - \$34,391 |

| Total Value | + \$4735 | - \$853 | - \$6,394 | - \$11,891 | - \$17,347 | - \$22,765 | - \$28,148 |

- The delta in the table below shows that I am “money ahead” by purchasing the Kona for all years except year 5, but after that the lower running costs of the Kona erase that gap by year 7.

| Value Delta | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|

| Purchase Kona “Total Value” | + \$13,816 | + \$11,548 | + \$9,280 | - \$6,566 | - \$18,850 | - \$23,407 | - \$27,688 |

| Keep Corolla “Total Value” | + \$4735 | - \$853 | - \$6,394 | - \$11,891 | - \$17,347 | - \$22,765 | - \$28,148 |

| Delta | + \$9081 | + \$12401 | + \$15674 | + \$5325 | - \$1503 | - \$642 | + \$460 |