Crypto Mining and Trading Tax Implications

Note: This is not legal or financial advice, and I am not an attorney or an accountant. This is just the notes of someone trying to figure out their taxes.

Notes in next two sections, below, are partially based on this IRS Guidance On Cryptocurrency Mining Taxes blog post, written by Justin Woodward, a Crypto Tax Attorney, and this 2020 Guide to Cryptocurrency Taxes. Both are hosted on TaxBit.com.

IRS Guidance on Cryptocurrency Mining Taxes

References: Rev. Rul. 2019-24 and FAQ

- Crypto mining taxes are equivalent to ordinary income taxes. Miners must report the fair market value of the mined coins at time of receipt as gross income.

- Since there is no employer to issue a W-2 and most mining companies are not issuing 1099s, so it is the responsibility of the miner to keep detailed records of the date and fair market value of the mined crypto.

- How mined crypto is reported depends on whether the mining crypto is a hobby or a business:

- Hobby: reported on Form 1040 Schedule 1 as “other income”. No deductions allowed. Ref TaxBit’s guid on cryptocurrency tax forms.

- Business: reported on Schedule C. Eligible for deductions. Required to pay the self-employment tax.

- Frequent expenses that are eligible for the trade or business expense deduction include:

- Equipment: cost of mining equipment can be deducted from their ordinary mining income.

- Electricity Costs: must be the electricity that is solely used for mining.

- Repairs: expenses to make repairs may be eligible for the trade or business deduction. Best to save receipts to validate the expenses, in case of an audit.

- Rented Space: if you rent space to hold and run mining equipment then you may be eligible to deduct rental costs as an expense.

Most Trusted 2020 Guide to Cryptocurrency Taxes

- IRS defines cryptocurrency as “Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value other than a representation of the United States dollar or a foreign currency.” - Rev. Rul. 2019-24

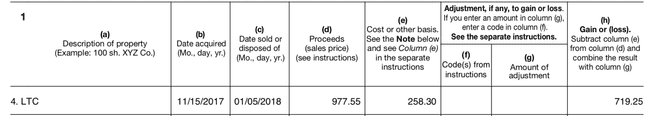

- IRS Notice 2014-21 states that virtual currency is treated as property for tax purposes. So, cryptocurrency is taxed as a capital asset and every taxable event must be report on an IRS 8949 cryptocurrency tax form.

- IRS 8949 ref info from TaxBit

Image above from TaxBit website

- Transferring assets between exchanges does not constitute disposition of an asset and therefore does not need to be reported as a taxable transaction.

- Buying cryptocurrency is not a taxable event, but does set the taxpayer’s cost basis in the asset.

- IRS Rev. Ruling 2019-24 specifies that it only allows for two cost basis assignment methods:

- First in first out (FIFO) (this is the preferred option) and

- specific identification

- Taxpayers can account for all fees by adding them into their acquisition and disposition costs:

- Ex: if you buy \$10,000 of Bitcoin and pay \$500 of fees, the cost basis can be reported as \$10,500. If you later sell the Bitcoin for \$11,000 and pay \$500 of fees, then the proceeds are \$10,500, therefore there are no taxable gains.

- If you hold a particular crypto for one year or less, your transactions constitute short-term capital gains. These are added to your income and taxed at ordinary income tax rates (10%, 12%, 22%, 24%, 32%, 35%, 37%).

- If you hold a particular crypto for more than one year, your transactions are eligible for tax preferred long-term capital gains. For single filers:

- 0% if income is less than \$39,375,

- 15% if income is more than that but less than \$434,550,

- 20% otherwise

- If a taxpayer is filing their own taxes they can easily upload their IRS 8949 tax forms into a popular tax filing software such as TurboTax.

- Some exchanges have issued 1099-K’s, which is an informational return that sums up the total value a user has received throughout the year - these report only the total value exchanged and fail to include proper adjustments for cost basis.

- Many people who receive 1099-K’s from exchanges may receive an IRS CP2000 letter for unreported income two years later.

- 1099-B’s report cost basis when available and are designed to be transposed onto an IRS 8949. Gains reported on an IRS 8949 are taxed pursuant to capital gains treatment instead of ordinary income.

- Many exchanges have already switched to 1099-B reported, as it is the accurate tax form and a better experience for the taxpayer.

Notes below are based on IRS Tax Tip 2020-108, dated August 25, 2020.

Earning side income: Is it a hobby or a business?

- Business: operates to make a profit.

- Hobby: for sport or recreation, not to make a profit.

- Nine considerations to determine business/hobby:

- Whether the activity is carried out in a businesslike manner and the taxpayer maintains complete and accurate books and records.

- Whether the time and effort the taxpayer puts into the activity show they intend to make it profitable.

- Whether they depend on income from the activity for their livelihood.

- Whether any losses are due to circumstances beyond the taxpayer’s control or are normal for the startup phase of their type of business.

- Whether they change methods of operation to improve profitability.

- Whether the taxpayer and their advisors have the knowledge needed to carry out the activity as a successful business.

- Whether the taxpayer was successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years and how much profit it makes.

- Whether the taxpayers can expect to make a future profit from the appreciation of the assets used in the activity.