Accounting Environment, Decision-Making & Theory

Objectives: demonstrate an understanding of the foundational principles and objectives of accounting; apply the accounting equation to illustrate the impact of business transactions and to transform business transactions (data) into usable information; and identify the foundational accounting concepts, assumptions, or principles through the analysis of specific business situations.

1.1: The Accounting Environment

Notes from chapter 1, pages 14-29 of Accounting Principles: A Business Perspective, Financial Accounting (Chapters 1 – 8) by Textbook Equity, licensed CC-BY-NC-SA:

Objectives: Define accounting. Describe the functions performed by accountants. Describe employment opportunities in accounting. Differentiate between financial and managerial accounting. Identify several organizations that have a role in the development of financial accounting standards.

- 1.1 Learning Objectives

- You probably will find that of all the business knowledge you have acquired or will learn, the study of accounting will be the most useful.

- The accounting system of a profit-seeking business is an information system designed to provide relevant financial information on the resources of a business and the effects of their use.

- 1.2 Accounting Defined

- The American Accounting Association—one of the accounting organizations discussed later in this Introduction—defines accounting as “the process of identifying, measuring, and communicating economic information to permit informed judgments and decisions by the users of the information”.

- Accounting is often confused with bookkeeping. Bookkeeping is a mechanical process that records the routine economic activities of a business. Accounting includes bookkeeping but goes well beyond it in scope.

- Accountants analyze and interpret financial information, prepare financial statements, conduct audits, design accounting systems, prepare special business and financial studies, prepare forecasts and budgets, and provide tax services.

- 1.3 Employment opportunities in accounting

- An accountant may become a Certified Public Accountant (CPA) by passing an examination prepared and graded by the American Institute of Certified Public Accountants (AICPA) and obtaining a state license.

- Big-Four international CPA firms: Deloitte & Touche, Ernst & Young, KPMG, and Pricewaterhouse Coopers

- 1.4 Financial accounting versus managerial accounting

- Financial Accounting is primarily for those outside the company and focuses on the company as a whole

- Six types of external users: Owners and prospective owners, creditors and lenders, employees and their unions, customers, government units, general public

- Financial Statements are formal reports providing info on a company’s financial position, cash inflows and outflows, and results of operations

- Managerial Accounting is primarily for those inside the company and focuses on parts or segments of the company

- Four major types of decisions: financial decisions, resource allocation decisions, production decisions, marketing decisions

- Financial Accounting is primarily for those outside the company and focuses on the company as a whole

- 1.5 Development of financial accounting standards

- GAAP (Generally Accepted Accounting Principles) have been established and contributed to by several different organizations over time

- Three key contributors are the Securities and Exchange Commission (SEC), the Financial Accounting Standards Board (FASB), and the American Accounting Association (AAA)

1.1.1: Financial Accounting vs. Managerial Accounting

Notes from introduction and chapter 1.1 of Managerial Accounting by Saylor Academy, licensed CC BY-NC-SA 3.0:

- Companies generally prefer not to disclose more information than is required by U.S. GAAP, but they would like to have more detailed information available for internal decision-making and performance-evaluation purposes. This is the reason for the distinction between Financial Accounting and Managerial Accounting.

- Financial Accounting focuses on providing historical information to external users: owners (shareholders) and creditors (banks or bondholders)

- Examples: Income statement for most current year, prepared in accordance with U.S. GAAP, balance sheet at the end of the current year, prepared in accordance with U.S. GAAP

- Managerial Accounting focuses on internal users: executives, product managers, sales managers, any other personnel who use accounting info to make important decisions

- Examples: profitability on a per-product level, projected net income for next quarter by division, defective goods produced as a percentage of all goods produced, monthly sales broken down by geographic region, production department budget for the next quarter

- Financial Accounting focuses on providing historical information to external users: owners (shareholders) and creditors (banks or bondholders)

| Managerial Accounting | Financial Accounting | |

|---|---|---|

| Users | Inside the organization | Outside the organization |

| Accounting rules | None | U.S. Generally Accepted Accounting Principles (U.S. GAAP) |

| Time horizon | Future projections (sometimes historical if in detail) |

Historical information |

| Level of detail | Often presents segments of an organization (e.g., products, divisions, departments) |

Presents overall company information in accordance with U.S. GAAP |

| Performance measures | Financial and nonfinancial | Primarily financial |

1.1.2: The Development of Financial Accounting Standards

Notes on Conventions and Standards by Boundless licensed CC BY-SA 4.0:

- Standard-Setting Groups: SEC, AICPA, and FASB

- The U.S. Securities and Exchange Commission (SEC) is a federal agency that holds primary responsibility for enforcing the federal securities laws and regulating the securities industry, the nation’s stock and options exchanges, and other electronic securities markets in the United States.

- The American Institute of Certified Public Accountants (AICPA) is the national professional organization of Certified Public Accountants (CPAs) in the United States. It also develops and grades the Uniform CPA Examination.

- The Financial Accounting Standards Board (FASB) is a private, not-for-profit organization whose primary purpose is to develop generally accepted accounting principles (GAAP) within the United States in the public’s interest.

- Generally Accepted Accounting Principles (GAAP) refer to the standard framework of guidelines for financial accounting used in any given jurisdiction; generally known as accounting standards. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing accounting transactions, and in the preparation of financial statements. GAAP is a codification of how CPA firms and corporations prepare and present their business income and expense, assets, and liabilities in their financial statements. GAAP is not a single accounting rule, but rather an aggregate of many rules on how to account for various transactions.

- GAAP Five Basic Constraints:

- Objectivity principle: the company financial statements provided by the accountants should be based on objective evidence.

- Materiality principle: the significance of an item should be considered when it is reported.

- Consistency principle: the company uses the same accounting principles and methods from year to year.

- Conservatism principle: when choosing between two solutions, the one that will be least likely to overstate assets and income should be picked.

- Cost-Benefit Relationship: the company considers the costs necessary to prepare the information and what benefits users will get from it.

- GAAP Five Basic Constraints:

- The IFRS is a common global financial language for business affairs that is understandable and comparable across international boundaries.

- The convergence of accounting standards refers to the goal of establishing a single set of accounting standards that will be used internationally to reduce the differences between US GAAP and IFRS.

- Convergence is also taking place in other countries, with “all major economies” planning to either adopt the IFRS or converge towards it, “in the near future”.

- A major difference between GAAP and IFRS is that GAAP is rule-based, whereas IFRS is principle-based.

- The full disclosure principle states information important enough to influence decisions of an informed user should be disclosed.

- The Disclosure Process - The process of disclosing financial statements is carried out through what is known as a Form 10-K.

- The process of disclosing financial statements is carried out through what is known as a Form 10-K. This is an annual report required by the U.S. Securities and Exchange Commission (SEC) that gives a comprehensive summary of a company’s performance.

- The structure of a Form 10-K is clearly defined and consists of 4 parts with 15 schedules.

- Current Issues in Reporting and Disclosure

- Mark-to-market or fair-value accounting refers to accounting for the fair value of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed “fair” value.

- Mark-to-market accounting can change values on the balance sheet as market conditions change.

- Stock option expensing is a method of accounting for the value of share options, distributed as incentives to employees, within the profit and loss reporting of a listed business.

1.2: Foundational Business and Accounting Concepts and Transaction Analysis

1.2.1: Basic Accounting Concepts

Notes on GAAP Principles and Concepts by Dave Alldredge licensed CC BY 3.0:

- Accounting has many principles and concepts that help determine the correct way to account for transactions:

- Economic Entity Concept: A business is a separate economic entity from its owners

- But, there may be no difference between business and owner legally and from tax standpoints

- This separation specifically pertains to the preparation of financial statements

- Going Concern: Assumption that a business will continue indefinitely into the future unless otherwise reported

- Cost Principle: Requires assets to be record at their purchase price, which we call “cost”

- The cost is verifiable and reliable

- Value of assets is not increased when their fair market value increases because fair market value is less verifiable and reliable

- Some minor exceptions to this rule exist, but these are advanced topics

- Monetary Unit Principle: Financial transactions must be recorded and reported in a stable and accepted unit of measure

- Typically USD, euros, pounds, or the currency of the country

- Economic Entity Concept: A business is a separate economic entity from its owners

1.2.2: Introducing Financial Statements

Notes on Interpreting Corporate Financial Statements by Dave Alldredge licensed CC BY 3.0:

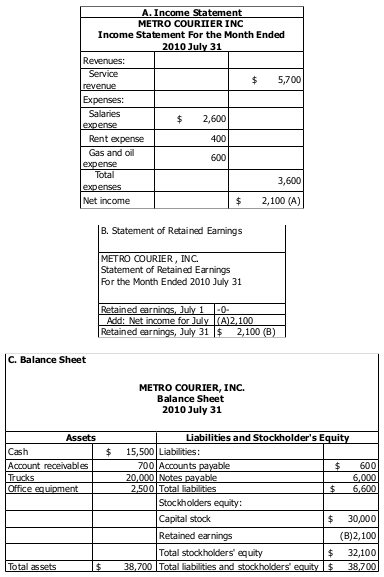

- Financial Accounting records the financial transactions of a business and communicates this information to potential investors and creditors. The output of the accounting process is financial statements:

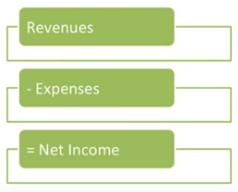

- Income Statement: reports a business’s profitability

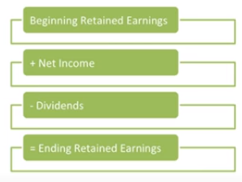

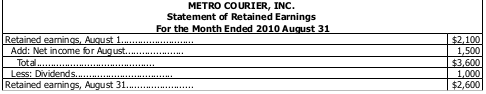

- Statement of Retained Earnings: reports the change in retained earnings

- Balance Sheet: details economic resources and the claims on those resources

- Statement of Cash Flows: summarizes the cash inflows and outflows for various business activities

- Income Statement: Also known as “Statement of Operations” or “P & L” statement

- Reports two main categories: revenues and expenses

- Shows the “bottom line”: net income or net loss for the period

- Net income is the most important item in the financial statements. It is one of the first things investors and creditors look for in financial statements.

- Statement of Retained Earnings

- Prepared after the income statement because info from the income statement is used in the statement of retained earnings

- Retained Earnings is the portion of earnings retained by a company rather than being paid to investors in the form of a dividend

- Net income (or net loss) flows from the Income Statement to the Statement of Retained Earnings

- Balance Sheet: Also known as “Statement of Financial Position”

- Reports Assets, Liabilities, and Stockholders' Equity

- A “Classified Balance Sheet” has assets and liabilities split into two categories based on a one-year cutoff:

- Current: < 1 year

- Assets: Cash, Short-term investments, accounts receivable, inventory, prepaid expenses

- Liabilities: Accounts payable, income taxes payable, accrued expenses

- Long-Term: > 1 year

- Assets: Property, plant, equipment (Land, buildings, equipment), intangibles, long-term investments

- Liabilities: Long-term notes payable, mortgage payable, bonds payable

- Current: < 1 year

- Stockholders' Equity: commonly divided into two categories:

- Contributed Capital: common stock, preferred stock, additional paid-in capital

- Retained Earnings: ending retained earnings, from the statement of retained earnings

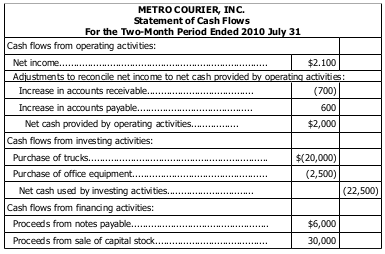

- Statement of Cash Flows: reports the change in cash for a reporting period

- Explains the change in the cash account

- Reports the cash receipts and payments from three categories of activities:

- Operating: cash receipts and payments from selling goods and services

- Investing: buying and selling long-term assets

- Financing: issuing stock and borrowing or repayment of debt

1.3: Accounting and Its Use in Business Decisions

Notes from chapter 2, pages 30-53 of Accounting Principles: A Business Perspective, Financial Accounting (Chapters 1 – 8) by Textbook Equity, licensed CC-BY-NC-SA:

- 2.2 A career as an entrepreneur

- Financial statements show the results of decisions made by management.

- In this chapter, you also study the accounting process (or accounting cycle) that accountants use to prepare those financial statements.

- 2.3 Forms of business organizations

- Business entity concept: each business organization or entity has an existence separate from its owner(s), creditors, employees, customers, and other businesses. This concept applies to the three forms of businesses—single proprietorship, partnerships, and corporations:

- A single proprietorship is an unincorporated business owned by an individual and often managed by that same person. The owner is solely responsible for all debts of the business.

- A partnership is an unincorporated business owned by two or more persons associated as partners. Each partner may be held liable for all the debts of the partnership and for the actions of each partner within the scope of the business.

- A corporation is a business incorporated under the laws of a state and owned by a few stockholders or thousands of stockholders.

- The corporation is unique in that it is a separate legal business entity. The owners of the corporation are stockholders, or shareholders. They buy shares of stock, which are units of ownership, in the corporation. The corporate form of business protects the personal assets of the owners from the creditors of the corporation.

- Stockholders do not directly manage the corporation. They elect a board of directors to represent their interests. The board of directors selects the officers of the corporation, such as the president and vice presidents, who manage the corporation for the stockholders.

- Business entity concept: each business organization or entity has an existence separate from its owner(s), creditors, employees, customers, and other businesses. This concept applies to the three forms of businesses—single proprietorship, partnerships, and corporations:

- 2.4 Types of activities performed by business organizations

- Three types of activities companies undertake: Service, Merchandising, and Manufacturing

- 2.5 Financial statements of business organizations

- Two goals of every business: Profitability is the ability to generate income. Solvency is the ability to pay debts as they become due.

- Unless a business can produce satisfactory income and pay its debts as they become due, the business cannot survive.

- Four basic financial statements together represent the profitability and strength of a company:

- Income statement: reflects a company’s profitability

- Statement of retained earnings: shows the change in retained earnings between the beginning and end of a period (ex a month or a year)

- Balance sheet: reflects a company’s solvency and financial position

- Statement of cash flows: shows the cash inflows and outflows for a company over a period of time

- Two goals of every business: Profitability is the ability to generate income. Solvency is the ability to pay debts as they become due.

Income Statement

- Revenues: inflows of assets resulting from the sale of products or the rendering of services to customers. Measured by prices agreed on in the exchanges in which a business delivers goods or renders services.

- Expenses: costs incurred to produce revenues. Measured by the assets surrendered or consumed in serving customers.

- Net Income = Revenues - Expenses

- Net Income is also known as the Earnings of the company. If expenses exceed revenue, the business has a net loss, and has operated unprofitably.

- Income Statement is about profitability

Statement of Retained Earnings

- One purpose of the Statement of Retained Earnings is to connect the Income Statement with the Balance Sheet

- It explains the changes in retained earnings between two balance sheet dates - usually they consist of the addition of net income (or deduction of net loss) and the deduction of dividends.

- Dividends are the means by which a corporation rewards its owners for providing it with investment funds.

- It is a distribution of income to owners, not an expense, so it does not show up on the income statement

- It reduces cash and retained earnings by the amount paid out

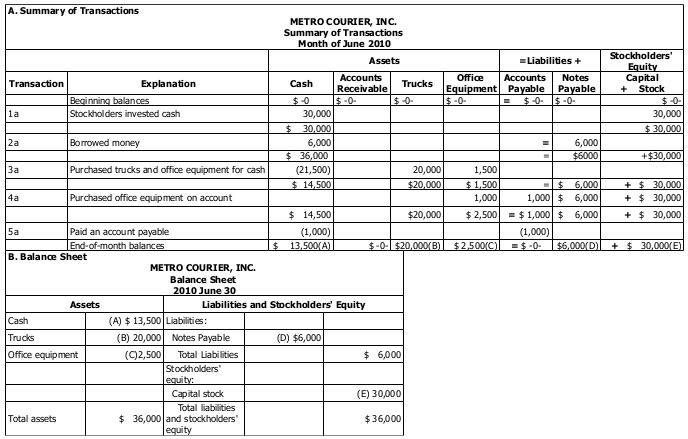

Balance Sheet

- Balance Sheet, AKA Statement of Financial Position, lists the company’s assets, liabilities, and stockholders' equity in dollar amounts as of a specific point in time - close of business on the date of the balance sheet.

- Income Statement and Statement of Retained Earnings are for a period of time

- Balance Sheet is about solvency

- Assets: things of value owned by the business, AKA the resources of the business, including cash, accounts receivable, equipment, etc.

- Liabilities: debts owed by a business, including accounts payable and notes payable.

- Stockholders' Equity: owners' interest in a corporation. Capital stock shows the amount of owners' investment. Retained Earnings consists of the accumulated net income of the corporation minus dividends distributed.

- Note dollar amount of total assets = claims on (or interest in) those assets.

Relationship of Income Statement, Retained Earnings Statement, Balance Sheet:

Statement of Cash Flows

- Statement of Cash Flows determines the company’s cash available to pay bills when due.

- Shows the cash inflows/outflows from Operating, Investing, and Financing activities

- Operating activities: include cash effects of transactions and other events impacting net income calculations

- Investing activities: include business transactions involving the acquisition or disposal of long-term assets like land, buildings, equipment

- Financing activities: include the cash effects of transactions and other events involving creditors and owners

- Shows the cash inflows/outflows from Operating, Investing, and Financing activities

- 2.6 The financial accounting process

- Accounting Equation: Assets = Liabilities + Stockholders' Equity

- Together, creditors and owners provide all the assets in a corporation

- Higher the proportion of assets provided by owners, the more solvent the company

- However, companies can somtimes improve profitability by borrowing from creditors and using the funds effectively

- Together, creditors and owners provide all the assets in a corporation

- Accounting transaction is any business activity or event that causes a measurable change in the accounting equation

- Ex: exchange of cash for merchandise

- Source document: written or printed evidence of a business transaction that describes the essential facts of the transaction

- Accounting Equation: Assets = Liabilities + Stockholders' Equity

- 2.7 Underlying assumptions or concepts

- Business entity concept: assumes that each business has an existence separate from its owners, creditors, employees, customers, other interested parties, and other businesses

- Money measurement concept: economic activity is recorded and reported in a common unit of measure (dollars)

- Exchange-price (or cost) concept: most assets are recorded at their acquisition cost

- Going-concern concept: accountants assume that the business entity will continue operations into the indefinite future, which allows accountants to value long-term assets (like land) at cost on the balance sheet

- Periodicity concept: an entity’s life can be meaningfully subdivided into time periods (moths or years) to report results of economic activities

- 2.8 Transactions affecting only the balance sheet

- Examples: Owners invested cash, borrowed money from a creditor, purchased trucks and office equipment for cash, purchased office equipment on account, paid an account payable

- People do not form a business to hold existing assets, though - they form businesses so their assets can generate greater amounts of assets

- Examples: Owners invested cash, borrowed money from a creditor, purchased trucks and office equipment for cash, purchased office equipment on account, paid an account payable

- 2.9 Transactions affecting the income statement and/or balance sheet

- People do not form a business to hold existing assets, though - they form businesses so their assets can generate greater amounts of assets

- Revenues earned by providing goods and services must exceed the expenses incurred - IE business must be profitable. Hence the income statement:

…

- 2.10 Summary of balance sheet and income statement transactions

- 2.11 Dividends paid to owners (stockholders)

- 2.12 Analyzing and using the financial results—the equity ratio